9 AM to 6 PM. Tax rebate for Self.

Special Report Gleaning Insights From The 2019 Household Income Survey The Edge Markets

Companies with gross turnover greater than NGN 100 million assessed on a preceding year basis ie.

. Tax is charged on profits for the accounting year ending in the. Upper middle income from The World Bank. Domestic travel travelling within Malaysia expenses have RM100000 tax relief.

Resident companies are liable to corporate income tax CIT on their worldwide income while non-residents are subject to CIT on their Nigeria-source income. Malaysia Corporate Income Tax Guide. Foreign-Sourced Income for Malaysia Taxation.

There are unlimited tax reliefs for Zakat expenses for Muslims who have to make this compulsory contribution. Malaysia adopts a territorial system of income taxation. Plus you get to pat yourself on the back after doing a pretty good deed.

Level 20 Menara Centara No. Heres quick scenario to briefly illustrate how the whole thing works. Territorial basis of taxation.

A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. Which basically means that each friend hired would let you walk away with some side income at the end of the day. Income derived from sources outside Malaysia and remitted by a resident company is exempted from tax except.

A calculation is done to determine if you have tax to pay or are indeed eligible for a rebate. Your aggregate income is essentially the total of all your taxable income from employment rent royalties and so on. Ahmad has an aggregate income of RM60000 and makes a donation of RM5000 to an approved institution in March 2021.

Since this donation is limited to 10. 360 Jalan Tuanku Abdul Rahman 50100 Kuala Lumpur Malaysia Tel. Our Award and Recognition.

The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA. To name a few some online recruitment portals in Malaysia that offer up such services include Seekers and Jobsco. Get tax saving worth RM300000 for childcare expenses for children up to 6 years old.

After the Asian financial crisis of 1997-1998 Malaysias economy has been on an upward trajectory averaging growth of 54 since 2010 and is expected to achieve its transition from an upper middle-income economy to a high-income economy by 2024. A company or corporate whether resident or not is assessable on income accrued in or derived from Malaysia. If your chargeable income does not exceed RM 35000 after the tax reliefs and.

The CIT rate is 30 for large companies ie.

Malaysia Average Monthly Salary 2020 Statista

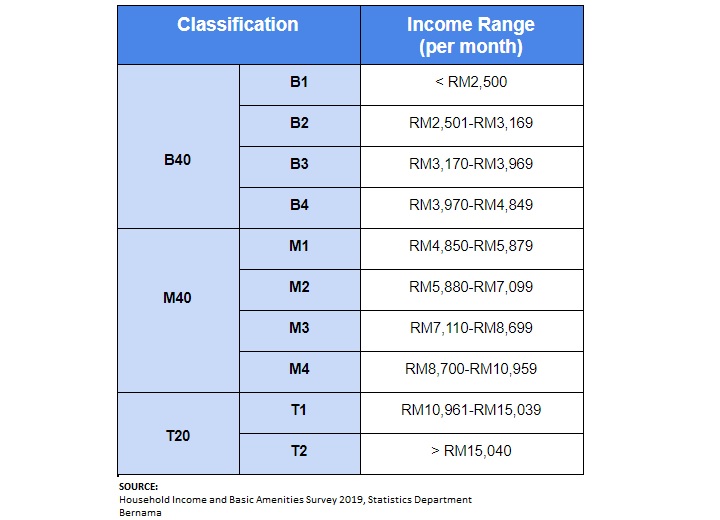

T20 M40 And B40 Income Classifications In Malaysia

T20 M40 And B40 Income Classifications In Malaysia

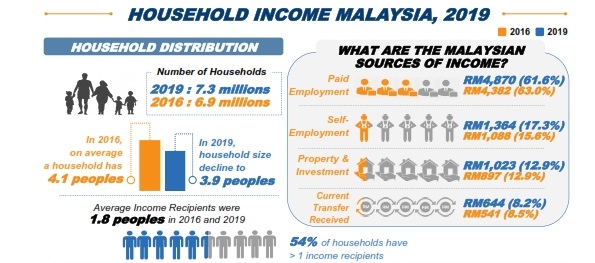

Department Of Statistics Malaysia Official Portal

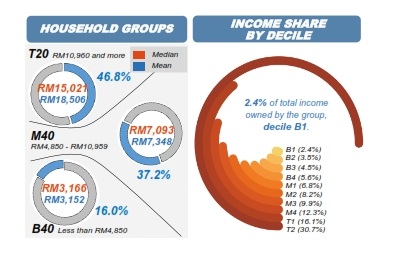

B40 M40 T20 The New Figures In 2020 Trp

Special Report Gleaning Insights From The 2019 Household Income Survey The Edge Markets

T20 M40 And B40 Income Classifications In Malaysia

Vietnam Household Income Per Capita 1994 2022 Ceic Data

Special Report Why High T20 Numbers May Have Scant Meaning The Edge Markets

Malaysian Salaries Actually Increased In 2021 Jobstreet Says Life

Malaysia S Income Classification What S T20 M40 B40 Meaning

Special Report Gleaning Insights From The 2019 Household Income Survey The Edge Markets

B40 M40 T20 The New Figures In 2020 Trp

Malaysian Salaries Actually Increased In 2021 Jobstreet Says Life

Household Income Group Malaysia And How Much One Should Pay For A Property

B40 M40 T20 The New Figures In 2020 Trp

Special Report Why High T20 Numbers May Have Scant Meaning The Edge Markets

Department Of Statistics Malaysia Official Portal

Cover Story Redefining The M40 The Edge Markets